housing allowance for pastors form

Pastoral Housing Allowance for 2021. 0 2 METHOD 3.

If you receive as part of your salary for services as a minister an amount officially designated in advance of payment as a housing allowance and the amount.

. Not every staff member at the church can take this allowance. Example Of Pastors W-2 Form. The eligible housing allowance amount is exempt from federal income taxes but not from self-employment taxes Social Security and medicare unless a minister has filed a Form 4361 and been approved to opt out of social security.

From board of pensions as noted on IRS Form 1099R _____ 2-b Total officially designated housing allowance. Ministers Compensation Housing Allowance 1 Question. Obtain the current fair rental value of your home from a local realtor or someone in the.

Request for Taxpayer Identification Number TIN and Certification Form 4506-T. Ad Clergy Housing Allowance Worksheet More Fillable Forms Register and Subscribe Now. Taxes with housing allowance Salary of 50000 Housing Allowance of 28000 Reduction of Taxable Income 50000 - 28000 22000 Taxed on 22000 12 2640 Owed income tax of 2640.

The same goes for a housing allowance paid to ministers that own or rent their homes. Each year your congregation votes on the terms of call for your pastoral staff. Housing allowance designated by the church or other employer _____ 2a Board of pensions as noted on IRS Form 1099R _____ 2b 2T Total officially designated housing allowance.

Instructions for Form 1040 Form W-9. Unless a church includes it in an informational section on Form W-2 the IRS and the Social Security Administration SSA are only made aware of the housing allowance when a minister files. ChurchPay Pros by AccuPay will provide the amount of a pastors compensation designated as housing allowance in Box 14 of the pastors W-2 to assist tax preparers.

Fair rental value of house furnishings utilities. HOUSING ALLOWANCE APPROVAL FORM Name Printed_____. Resolved that the designation of Amount 00000 as a housing allowance shall apply to calendar year 20__ and all.

How is the housing allowance reported for social security purposes. So if youre receiving 5000 in a housing allowance and the fair market rental value of the home dips to 4000 you can only exclude 4000 from your gross income. It is time again to make sure you update your housing allowance resolution.

Only expenses incurred after the allowance is officially designated can qualify for tax exemption. Individual Income Tax Return. The housing allowance can be amended in midyear per the same approval process yet housing allowance.

Its suggested that you validate this number by checking with a local realtor. It is reported by the pastor on Schedule SE of Form 1040 line 2 together with salary. In this situation that extra 1000 has to be included as part of your wages on line 7 of your Form 1040 US.

IRC 107 is an amount that the pastor can elect out of the salary to cover housing expenses including expenses that a Housing Allowance does not cover if there is one. The housing allowance for pastors is not and can never be a retroactive benefit. Section 107 of the Internal Revenue Code clearly allows only for ministers of the gospel to exclude some or all of their ministerial income as a housing.

Ready-to-use resolution language for church board to set a clergy housing allowance in 2022. Church Treasurers Year-end Worksheet. Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church - The Pastors Wallet.

Housing Allowance - Fill Online Printable Fillable Blank Pdffiller. The total housing allowance payments can be reported in Box 14 which is simply an informational box for the employee. The housing allowance is for pastorsministers only.

Most ministers and Pastors are considered employees of the church so you would report their compensation on a W-2with the salary reported in Box 1 and NOTHING in boxes 345 and 6. The church is not required to report the housing allowance to the IRS. Here are four important things that you need to know concerning the housing allowance.

According to tax law if you are planning to claim a housing allowance deduction actually an exclusion for the upcoming calendar year your Session is required to designate the specific amount to be paid to you as housing allowance prior to the. And it is further. Facts About Housing Allowance for Pastors.

Ordained clergy are not required to pay federal or state except in Pennsylvania income taxes on the amount designated in advance by their employer as a clergy housing allowance to the extent. This is not included in taxable income on the W-2. What Is Included In Clergy Housing Allowance - Fill Online Printable Fillable Blank Pdffiller.

While this Regulation does not require the designation. Housing Allowance Calculation Form for Ministers Who Own or Rent Their Own Home This form is for helping ministers determine the appropriate amount to claim as housing allowance. Find Free WordPress Themes and pluginsHousing Manse Parsonage Designation The Regulations require that the housing allowance be designated pursuant to official action taken in advance of such payment by the employing church or other qualified organization.

Therefore it is important to request your housing allowance and have it designated before January 1 so that it is in place for all of 2020. Ministers who own or rent their home are not required to pay federal income taxes on. Fair rental value of house furnishings utilities.

Sample Housing Allowance for Pastors. One of the pieces of the terms of call is the housing allowance. Ministers Signature _____ Housing allowance for the forthcoming year of _____.

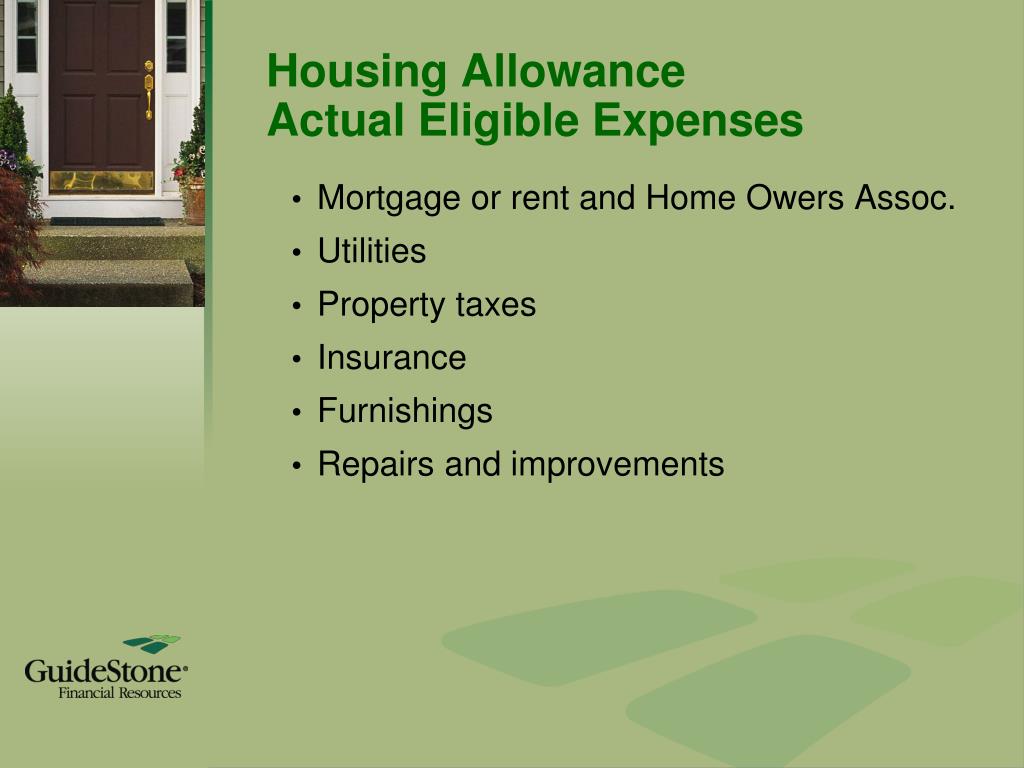

A ministers housing allowance sometimes called a parsonage allowance or a rental allowance is excludable from gross income for income tax purposes but not for self-employment tax purposes. This allowance is one of the most important tax benefits available to ministers who own or rent their homes. Are all ministers treated as self-employed for social security purposes.

October 8 2021. This is an excerpt from my book The Pastors Wallet Complete Guide to the Clergy Housing Allowance. I expect to incur the following expenses to rent or otherwise provide a home.

In this illustration there is a 3360 tax savingswith the Housing Allowance. Church boards can use the language below to create a resolution for a pastor who owns or rents a home. Resolved that the total compensation paid to Pastor FirstLast Name for calendar year 20__ shall be Pastors Compenstation 00000 of which Amount 00000 is hereby designated as a housing allowance.

Pin On Bussines Template Graphic Design

Ppt Housing Allowance Powerpoint Presentation Free Download Id 1544947

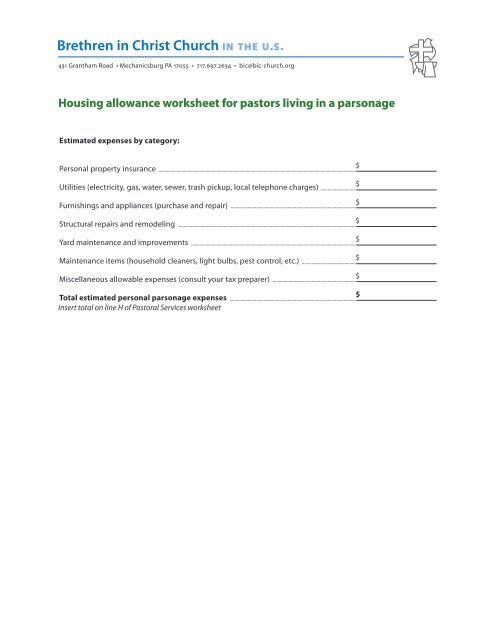

Housing Allowance Worksheet For Pastors Who Live In A Parsonage

Fillable Online Agncn Housing Allowance Request Ncn Assemblies Of God Agncn Fax Email Print Pdffiller

Housing Allowance Worksheet Clergy Financial Resources Download Fillable Pdf Templateroller Housing Allowance Allowance Clergy

Pca Retirement Benefits Inc Housing Allowance Worksheet Fill And Sign Printable Template Online Us Legal Forms

Video Q A Do Additional Principal Payments Qualify For The Housing Allowance The Pastor S Wallet

The Pastor S Wallet Complete Guide To The Clergy Housing Allowance Kindle Edition By Artiga Amy Religion Spirituality Kindle Ebooks Amazon Com

Housing Allowance Worksheet Fill Online Printable Fillable Blank Pdffiller

Housing Allowance Worksheet Fill Out And Sign Printable Pdf Template Signnow

The Minister S Housing Allowance

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet

Get Your Free Downloadable 2019 Minister Housing Allowance Worksheet The Pastor S Wallet

The Pastor S Wallet Complete Guide To The Clergy Housing Allowance Kindle Edition By Artiga Amy Religion Spirituality Kindle Ebooks Amazon Com

What Is The Difference Between Clergy And Parsonage Housing Allowance Youtube

Housing Allowance Request Form Brokepastor

How The Clergy Cash Or Rental Housing Allowance Works The Pastor S Wallet Housing Allowance Finance Investing Clergy